Australian investors have for a long time chosen Australian shares and property for their investment portfolio, typically balancing this with cash and term deposits. The asset allocation of Self-Managed Super Funds in Australia illustrates this, with more than 26% of all SMSF assets invested in Australian shares, 16% invested in Australian property and 21% allocated to cash and term deposits[1].

It is worth remembering that nearly 40% of members in these funds are over retirement age, so many would be seeking a regular income from their investments while preserving investment capital.

Astute investors and their financial advisers are identifying a gap in their asset allocation. One that may be increasingly fulfilled by credit investments.

Share and property investments can provide valuable growth to a long-term investment portfolio but volatility impacts these returns. With share valuations climbing despite economic uncertainty as a result of COVID-19, significant risks remain on the horizon.

Cash and term deposit investments are barely delivering a positive interest rate, along with Australian government bonds. There is also a risk in fixed income investing that as interest rates or inflation rise, total returns from bond portfolios can fall. If this occurs in pre or early retirement phases, it can take its toll on a portfolio’s earning capacity, right when a retiree needs it most.

Corporate credit investments can become a valuable pillar in an income investor’s portfolio, providing capital stability and a regular income stream through varied market conditions. To ensure you avoid common traps when expanding your investment horizon there are some important considerations to make.

What is a defensive investment portfolio?

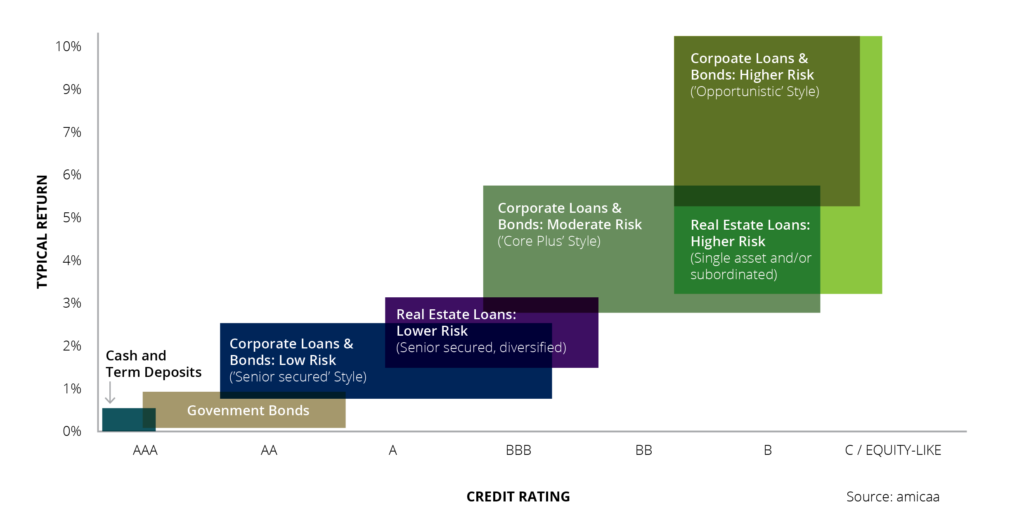

Defensive assets are those that can deliver more stable returns through all market conditions, with relatively low risk of capital loss. They will generally offer more modest returns than high growth investments such as shares and property. There is a spectrum of assets that might fulfil a defensive asset role in a portfolio – cash being the most stable, generally considered ‘risk free’ but offering very limited returns. Fixed income investments such as government bonds also fall into this category, offering higher returns than cash (although currently less than 1%), with some variability in results over the longer term.

Some property investments are considered defensive, particularly if they are in locations or industries that are proven as ‘essential’ for the community. This can be difficult to judge and all property investments carry risk – like equities – that the capital value of your investment may fall at different points in a cycle, impacting returns from your investment. For this reason, it can often sit at the most risky end of the ‘defensive asset’ categories.

Australian corporate credit

‘Corporate credit’ refers to the practice of lending to a company, on negotiated terms, in return for an interest rate that is typically set as a margin above the variable bank lending rate (see What is Australian Corporate Credit)? Investing in corporate credit is generally less understood among investors as it has historically been the domain of large banks. This is now changing – the large banks are adapting their business models and corporate borrowers are seeking more responsive, non-bank lender relationships (see Opportunity in Australian Credit). This has spurred development of the Australian private credit market and broader opportunities for income investors.

Institutional investors, such as many of Australia’s largest superannuation funds, have used allocations to Australian corporate credit to provide a defensive pillar to their investment portfolios during times of market uncertainty, with the benefit of a stable capital profile across a portfolio of assets and a strong, recurring income stream.

Source: amicaa

Australian corporate credit: understanding risk and return

When assets are carefully selected and managed Credit can perform an important role in a diversified portfolio:

- Borrowers are contractually required to pay regular interest or a coupon to the lender, which typically adjusts along with interest rates, providing a valuable boost to income as inflation or interest rates rise;

- Returns can be higher than similar fixed income securities, taking account of the credit rating of the borrowing company and the complexity of negotiating privately agreed financing arrangements;

- Strong protections exist for lenders in Australia, ensuring that their call on the assets of a company is placed ahead of other participants, such as shareholders or equity investors, in times of adversity;

- Careful selection and diversification of borrower companies can provide confidence in capital preservation; and

- Loan documentation can be carefully negotiated to enable a manager to liaise with a borrower throughout the lending process and ensure they can meet requirements of the loan over its typically three-to-seven-year term.

Delivering a stable income with capital preservation is appealing but what are the risks? The key risk is that a company defaults on its loan, placing capital invested and the income it generates at risk. For this reason, the most important decision made by a credit investor is the selection of borrower, making certain that the company is well positioned to ensure loans will be repaid in full and that appropriate buffers are in place to withstand changed business conditions. This credit assessment requires years of experience and is particularly important in private credit investments that are typically held to maturity, for up to seven years.

Periods of economic crisis can spur increased loan defaults – possibly characterised by a deferral of interest payments for some time or a reduction in capital recoverable from the loan. Different types of lending carry different risk profiles and if we consider ‘core plus’ style credit investing (illustrated by a typically BB risk rated credit instrument) during the 2008/9 Global Financial Crisis, actual losses from default events from US loans represented less than 2% of value. This type of loss could be recouped from the income profile of a diversified corporate loans portfolio.

Enhancing an income-oriented portfolio with corporate credit

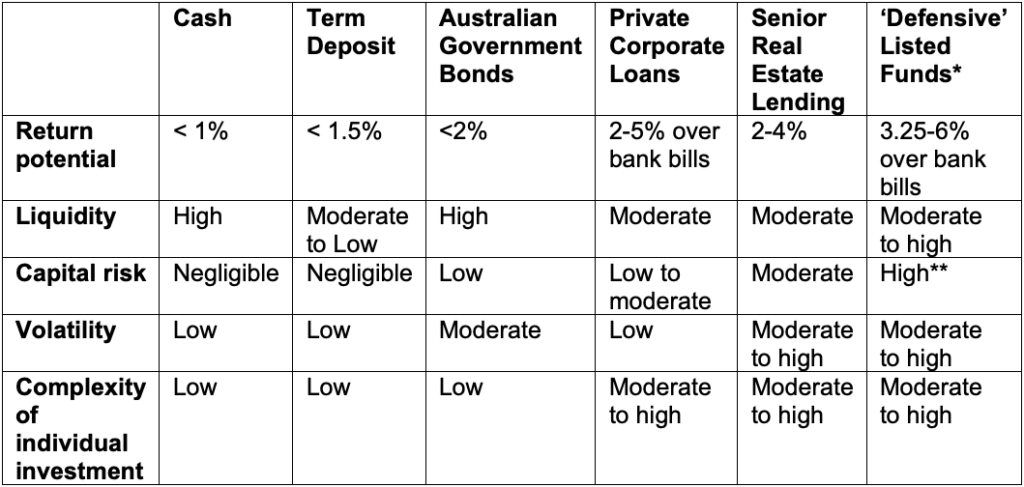

The following table compares a range of defensive asset types, to help place corporate credit investments into the context of common alternatives.

Defensive assets compared

Source: As at January, 2021; amicaa. * Listed Funds refers to ASX listed investment trusts or companies that invest in corporate or real estate debt, including (by ASX ticker): GCI, KKC, MXT, NBI, PGG, PCI and QRI.Source: As at January, 2021; amicaa. ** This assessment of capital risk for listed funds is driven by potential share market volatility when investors may wish to access capital, rather than the underlying volatility of portfolio holdings.

Investors seeking a reliable income can now look more broadly than cash and term deposits to achieve attractive returns, considering credit categories such as corporate credit, real estate lending and infrastructure debt. Each require a medium-term time horizon to take advantage of the premium available from private market investing. While some investors prioritise ready accessibility of their capital, this can come at a cost – market volatility impacting exchange traded funds or the opportunity cost of lower income over time. An experienced financial adviser can help you to consider these factors in constructing a strong and defensive investment portfolio for regular income and to understand the benefits of including Australian corporate credit in the portfolio mix.

For further information on Australian corporate credit investments, please contact amicaa on 1300 896 514, by email at [email protected] or visit www.amicaa.co.